January 2026: Severe correction in the broad market

In 2026

- January 2026: Severe correction in the broad market

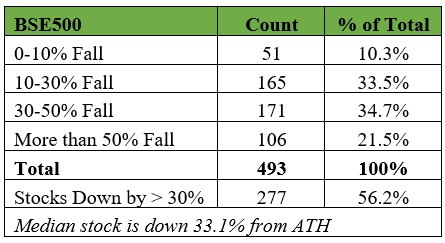

January 2026 was a tough month for the Indian markets. The Nifty was down 3.1%, the NSE Midcap150 index was down 3.5% and the NSE SmallCap250 index was down 5.5% this month. The Nifty is now down 4.0% from its All Time High (ATH), the Nifty Midcap Index is down 4.9% and the Nifty Small Cap Index is down 15.4% from their respective ATHs. The above figures, however, hide how much internal damage there has been to the market as a whole. Below we list the fall from their ATHs for the constituents of the BSE500 index, a broad index which is more representative of what is happening in the market. Seven of the 500 constituents have been excluded from the study because of demergers or other corporate action. Most of these ATHs have been hit over the last 18 months though a few made their ATHs in prior bull cycles.

The median stock in the BSE500 is down 33% from its ATH. That is indeed a deep cut. 56% of the BSE500 constituents are down more than 30%, and about 22% are down more than 50% from their ATHs. So, while the level of the indices does not cause a lot of alarm, the internals of the market suggest that the correction in the market is quite severe.

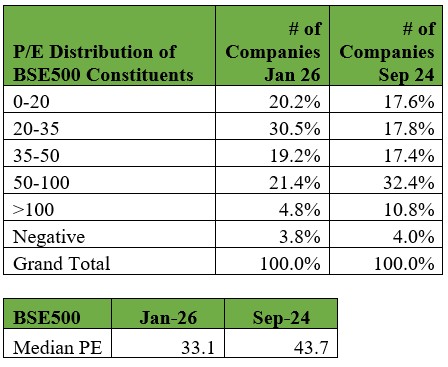

We now look at the distribution of the Trailing Twelve Month Price to Earnings Ratio (TTM PE) of the different constituents of the BSE500. This is something we wrote about in August 2024 and subsequent newsletters as well.

As we can see, the large correction in the prices of BSE500 constituents has brought down the median TTM PE from 43.7 in Sep 2024 to 33.1 now. While this has come down from egregious levels in Sep 2024, it is still on the higher side. As the distribution of TTM PEs has changed from Sep 2024 to January 2026, now more companies are available at a reasonable valuation than before. 50% of the companies are now trading below 35 TTM PE as compared to 35% in Sep-2024.

The dramatic fall in the broader market has opened many more opportunities for us to invest in. We have been writing for a long time that valuations are high and opportunities are few. Suddenly our research team is throwing multiple ideas at us, and we are carefully weighing these opportunities. Also, as the financial year now rolls over in a couple of months, we have rolled over all our valuation bands for different stocks in our universe to the next year. To the extent that there is growth in the underlying businesses, the valuation bands will move up to that extent. This will bring several more stocks into our consideration set and also increase conviction to add to existing positions.

It is difficult to predict how long this current downdraft in the Indian market will last and how deep it will go, but any further dips, are opportunities to buy. The reason we say this is that all the actions taken by the RBI and the government to stimulate growth over the last 12 months (CRR cuts, repo rate cuts, zero tax for sub Rs 12 lakhs income and the GST cuts) seem to be bearing fruit. We see an uptick in the early corporate results and also there is some improvement in some numbers like bank deposit and credit growth as also Medium and Heavy Commercial Vehicles. These are early signs and we hope that this will translate into higher revenue and profit growth for the portfolio companies. We own good quality businesses, and they have been bought at reasonable prices. The price of purchase will become even cheaper as time rolls on and revenues and earnings grow. Those of you who were anyway looking to add to your portfolio may add funds now.