June 2021: ROE – the core engine of wealth creation

In 2021

- December 2021: Why should one buy high quality companies

- November 2021: Strong corporate results in Sep 21 quarter cause for optimism

- October 2021: Cyclical upturn in the real estate sector?

- September 2021: Corporate tax growth implies strong corporate profit growth

- August 2021: Corporate results and tax revenues show encouraging trend

- July 2021: 17 year journey of Banyan Tree

- June 2021: ROE – the core engine of wealth creation

- May 2021: Nifty scales a new high

- April 2021: Why are markets not panicking in the second wave of covid in India?

- March 2021: Understanding the strength in the Indian equity market in the midst of covid

- February 2021: The role of interest rates in equity valuations

- January 2021: Economic recovery may be on its way

One of the first metrics that we look for in a high-quality business worth investing in, is the long term return on equity (ROE) of the business. ROE is the net profit divided by shareholders’ funds (or networth) of the business. This is the core engine of growth of a business – shareholders’ funds are the funds invested in the business and net profit is what is generated annually on these funds. Some part of the net profits is then distributed to shareholders as dividends and buy-backs and the rest redeployed in the business. The long-term ROE has a strong correlation with the long term returns provided by the company’s stock.

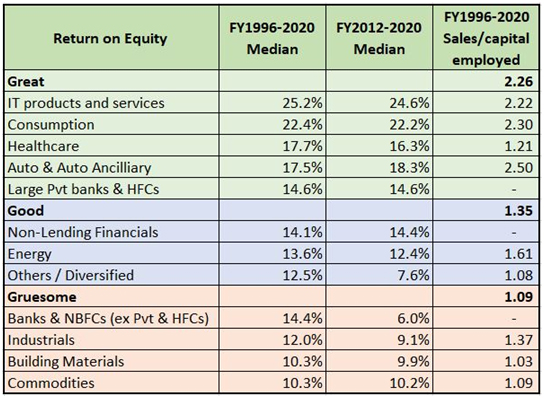

Below we have looked at the long-term ROEs of companies with a market capitalisation greater than Rs 500cr (sample set of 970 companies) belonging to different sectors and grouped them under Great, Good and Gruesome based on their long-term ROEs.

It appears that some sectors are naturally more inclined to make high ROEs – and while ROEs have declined as a whole for the period FY2012-20, they have held up much better for the companies in the Great category. Sectors with high ROEs naturally tend to be less capital intensive as reflected in the higher Sales/Total Capital Employed for these companies. This also explains our preference for businesses which are low on capital intensity – both fixed assets as well as working capital. You will also find that when we are choosing companies for our portfolio, we are often investing in sectors which belong to the Great and Good categories rather than in the Gruesome category. For ROEs to sustain over the long run, the business needs a competitive edge or ‘moat’ to keep competitors at bay – else the excess profitability will be eaten up by new competition. For this reason, we require all our investee companies to have a competitive edge.