April 2025: Tariffs – the sooner they are rolled back, the better

In 2025

- December 2025: What we learnt from Warren Buffett and Charlie Munger

- November 2025: Corporate results improving a little but valuations remain elevated

- October 2025: General insurance – underwriting discipline is key

- September 2025: High indebtedness of the world poses risks for investors

- August 2025: Strong monetary and fiscal policy actions to aid growth

- July 2025: Indian market valuations, though lower than the peak, remain high

- June 2025: Strong monetary and fiscal measures likely to boost economic growth

- May 2025: A glimpse into FY2025 earnings

- April 2025: Tariffs – the sooner they are rolled back, the better

- March 2025: FY2025 – a tale of two halves

- February 2025: Indian equity market falls for 5 consecutive months

- January 2025: Returns in Indian equities compensate for rupee depreciation

On 2 April 2025, a day he dubbed as “Liberation Day”, Donald Trump, the President of the US, announced “reciprocal” tariffs on almost all the countries in the world. There was a base tariff of 10% put on all imports into the US on a blanket basis and there was a long list of additional tariffs on different countries, not based on the tariffs they actually charge US products (as reciprocal tax would imply) but based on how much trade surplus that country had with the US as a proportion of its total trade with the US. Also conveniently ignoring the trade in services, where US has a huge surplus.

What is a tariff? A tariff, also called import duty, is a tax that is charged on any imports coming into a country and is paid by the buyer of the goods. A tariff provides protection to domestic manufacturers of the good because they have a price advantage to the extent of the tariff, over the imported goods and can compete more effectively with the imported product. As tariffs are designed to protect local industry, over the long term this leads to the domestic industry becoming less globally competitive.

As the world had globalized over the last several decades, tariff barriers had generally been on the decline. India saw its import duties being cut substantially, starting 1991 through an IMF recommended reform program. As such the whole world has benefited from higher global trade. The US President’s assertion that other countries are ripping US off appears false by the fact that only a few months back in January 2025, US constituted 50% of global market capitalization, and 26.8% of global GDP with only 4.2% of global population. Europe, with global population share of 9.1%, has a global GDP share of 17.0% and forms ~11% of global market cap.

Liberation Day proved to be devastating for global markets, especially the US stock and bond markets. Hitherto, most crises that we have witnessed over the last 25 years have been accompanied by US treasuries being regarded as safe haven for investors – the bond yields have typically fallen (bond prices rise as yields fall). In the past, this has been accompanied by the dollar strengthening. However, on this occasion as Donald Trump pushes the world into a trade war and has caused considerable uncertainty in the economic environment, what we have witnessed is a rise in US bond yields and the dollar crashing. The Dollar Index (DXY) fell 2.10% over 2 days (1st April to 3rd April). Only once before in history has the dollar had such a large 2-day fall – during covid.

On April 9th, Donald Trump, perhaps in response to the flaring bond yields and the crashing dollar, decided to walk back partially from the tariff measures he had announced on April 2, 2025. He retained the 10% tariff on all imports but removed the additional country wise tariffs for all countries except China. For China, tariffs have rapidly increased as China has responded to each increase by the US with about the same tariff on US goods entering China. It has also banned exports of several rare earth elements which are critical for several industries.

The stock market and the bond market rallied in relief on this walk back by Trump. The S&P500 is up 15.0% from the bottom of 4,835 and the 10-year bond yield has come down from a peak of 4.59% to 4.15% now. The dollar, however, is still down by 4.8% from Liberation Day.

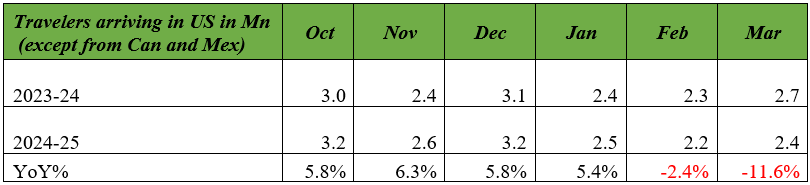

The last time the world experienced such high tariffs before this was in 1930. We are therefore going through a rare event in our history, and it may be a little arrogant for us to pretend that we know all the answers. The signs are not good. Below we present the arrivals of travellers into US for all countries except Canada and Mexico.

As we can see, ever since Trump won the election, and started a new brand of foreign policy, which alienated former allies and started strict border control, the traveller flow which was positive has turned negative.

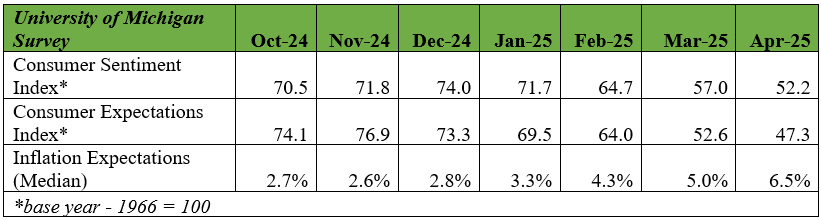

We now present the findings of the University of Michigan survey of consumers:

As we can see consumer sentiment has weakened significantly over the last six months and inflationary expectations are rising.

We think that tariffs is bad news for the global economy and the sooner they are rolled back, the better. As of now, there is no headway in negotiations between the US and its trading partners. This spells bad news because all global investment decisions are in flux. At the same time, there are spending cuts introduced by the US government as part of Department of Government Efficiency, headed by Elon Musk and otherwise through the budget approved by the House and the Senate. This could provide additional drag for the economy. What makes matters worse is that the budget deficit of the US for the six months ended 31-Mar-25 was $1.3 trillion (Budget year for the US is on a 30-Sep rolling basis). If we were to annualize this and divide by the estimate of 2025 GDP as per the Congressional Budget Office, a non partisan entity, we get a number of 8.6%!! It is hard to imagine a developed country rated more than AA+ by all rating agencies, having such a high number.

The Indian market has done reasonably well over the last month and the Nifty is up 3.5% for the month of April while the S&P is down 1.3%. The market perceives that India could end up being a beneficiary from the current circumstances for two reasons. 1) The tariffs imposed on China are prohibitively high at 145% and this could improve India’s chances as an alternative location to export to the US. 2) India was already conducting some sort of negotiations for a bilateral trade deal with the US even before Liberation Day and some sort of deal is expected in the next few months. Much will, however, also depend on the corporate performance, which has been weak in the last few quarters.

We had utilized the cash in the portfolio over the last few months to buy into good businesses which were available at reasonable prices, given the large fall in the market (median stock in BSE500 down 25.6% from 30 Sep 2024 to 28 Feb 2025). We have observed a rally over March and April, but the character of the rally suggests that the stocks rising are often not the ones which got beaten down a whole lot (many mid-caps and small caps in this). A different set of stocks (banking and financials for example) are leading this recent rally.

The events that are playing out on the global stage are historic and it is difficult to say how this will play out. US probably hoped for a surrender from China and its other trading partners. What is worth noting here is that US forms about 12% of China’s total exports. If we add potential re-routing through Vietnam and Mexico, this number may go up to 16-17% perhaps. In this trade war, US may not be as indispensable to China as Donald Trump believes. Which is why they have not made the call to the US as the US was expecting. As things stand today, there is not much headway in negotiations between US and any of its large trading partners. Meanwhile retailers in US are warning of a shortage of goods – this and the tariffs could push up inflation, keeping the Fed cautious in using monetary tools to bail out the US economy, which is weakening.

What worries us most is the continued uncertainty and the delay in decision making which is inevitable in this environment. No businessperson would make decisions, particularly capex decisions in an environment where they do not know whether whatever policy is announced today, would still be valid when the capex hits the ground. We hope this is resolved quickly – else it threatens the global economy.

We believe we own good businesses bought at reasonable prices and they should hold their ground over the medium term. In the short term their stock prices may remain somewhat dependent on the vagaries of the changing situation. We also have some cash which we can use to buy quality stocks if valuations fall.