July 2025: Indian market valuations, though lower than the peak, remain high

In 2025

- December 2025: What we learnt from Warren Buffett and Charlie Munger

- November 2025: Corporate results improving a little but valuations remain elevated

- October 2025: General insurance – underwriting discipline is key

- September 2025: High indebtedness of the world poses risks for investors

- August 2025: Strong monetary and fiscal policy actions to aid growth

- July 2025: Indian market valuations, though lower than the peak, remain high

- June 2025: Strong monetary and fiscal measures likely to boost economic growth

- May 2025: A glimpse into FY2025 earnings

- April 2025: Tariffs – the sooner they are rolled back, the better

- March 2025: FY2025 – a tale of two halves

- February 2025: Indian equity market falls for 5 consecutive months

- January 2025: Returns in Indian equities compensate for rupee depreciation

The Nifty after climbing for four months straight, took a pause in Jul 2025, and was down 2.9% for the month. From the low in April 2025, post Liberation Day, the Nifty is now up 13.9% and is 5.7% short of its All Time High of 26,277 in Sep 2024. On a year on year (yoy) basis though, the Nifty is down 0.7%. We thought this would be a good juncture to revisit some of the valuation metrics that we have discussed over the past 18 months with respect to the Indian market.

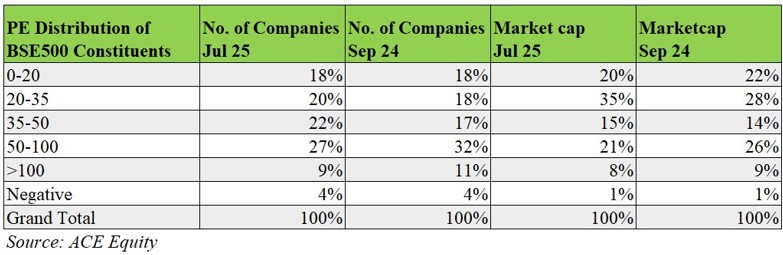

We first look at the distribution of trailing twelve-month PE (TTM PE) among the constituents of the BSE500 (Please refer to Aug 2024 newsletter for the prior reference to the same) and compare it with what was prevailing in Sep 2024 near the top of the market. We have divided all the constituents of the BSE-500 into 6 buckets on the basis of their TTM PE.

As we can see, there is a small change in the PE distribution with PEs in the range 0-35 totaling 38% in number in Jul 2025 versus 36% in Sep 2024. There are similarly small changes in the other buckets, all pointing to that PEs are now marginally lower than they were in Sep 2024. When we look at the distribution of market capitalization at different PE ranges (as opposed to number of companies), we find that there is a more marked shift in PEs to a lower range. The median PE of the constituents has come down from 43.7 in Sep 2024 to 39.6 in Jul 2025.

We now look at the PE of the BSE500 index as reported by BSE. This measures the aggregate PE for the index by dividing the total market cap of the BSE500 constituents by the sum of their earnings. Over the last 20 years the median PE of the BSE500 has had a range of 17.4 at the low and 25.1 at the high of the year. The most recent print for this PE is 24.9 and this number was at 27.9 on 30 Sep 2024. While valuations have come off a bit since Sep 2024, they remain close to the highs of the historical range.

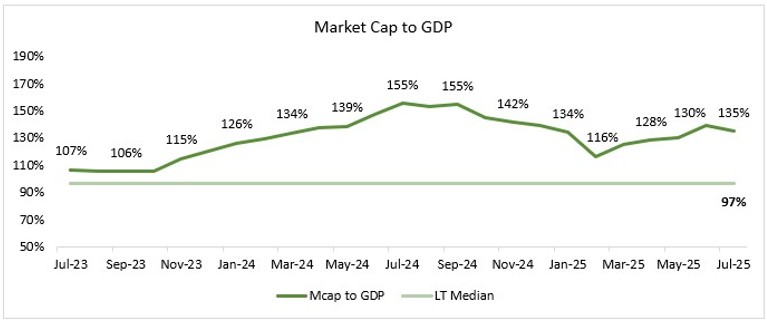

Now we look at the Market Cap to GDP ratio, a number we had last visited in our Mar 2024 newsletter. Below we present a graphical representation:

On market cap to GDP too, the valuation has come off from the highs of Sep-2024, but it is still significantly above its 20-year median of 97%.

All in all, while valuations have come off from the heady levels of Sep 2024, they remain significantly above their historical medians. At the same time, corporate results have been poor in recent times and the early numbers for Q1FY2026 are also not that encouraging. We will speak about that in more detail next month. We spoke last month about how the tax cut in the recent budget and the significant monetary policy moves from the RBI could help push growth from the poor levels recorded recently. Higher growth would certainly be needed to justify the valuations prevailing in the market currently.

When we look back to the time a year ago, we were more anxious about the valuations of the stocks in our portfolio than we are now. One year ago, the Nifty was exhibiting strength, and we used the opportunity to scale back or completely exit some of our holdings and in Sep 2024 we had significant cash in our portfolio. We used the fall in the market in the subsequent months to redeploy this cash into other high-quality companies which were trading at reasonable valuations and cash in the portfolio is much lower now. As of now, we feel more comfortable with the valuations of the stocks in our portfolio than we did a year ago. The huge monetary policy and fiscal policy move in terms of the repo rate and CRR cut as well as the tax break to those earning less than Rs 12 lakhs per annum, also provides some comfort that growth may pick up in the quarters to come. We do however remain cognizant of the risks to the market from the unusual tariff policy of the US. On balance, we believe that it is the quality of the companies we own and the valuations that they trade at, which should determine our performance over the long term.