June 2025: Strong monetary and fiscal measures likely to boost economic growth

In 2025

- December 2025: What we learnt from Warren Buffett and Charlie Munger

- November 2025: Corporate results improving a little but valuations remain elevated

- October 2025: General insurance – underwriting discipline is key

- September 2025: High indebtedness of the world poses risks for investors

- August 2025: Strong monetary and fiscal policy actions to aid growth

- July 2025: Indian market valuations, though lower than the peak, remain high

- June 2025: Strong monetary and fiscal measures likely to boost economic growth

- May 2025: A glimpse into FY2025 earnings

- April 2025: Tariffs – the sooner they are rolled back, the better

- March 2025: FY2025 – a tale of two halves

- February 2025: Indian equity market falls for 5 consecutive months

- January 2025: Returns in Indian equities compensate for rupee depreciation

On 6 Jun 2025, at its scheduled meeting, the monetary policy committee of the RBI decided to cut the repo rate (the rate at which the RBI lends to banks) by 50 basis points (bps – 1 bp is 0.01%) from 6.0% to 5.5%. It also cut the cash reserve ratio (CRR) by 100 bps from 4.0% to 3.0%. The CRR at the current level of 3.0% is the lowest in history, and equal to where it was during the covid pandemic.

The RBI had previously cut the repo rate by 25 bps on two occasions, on 7 Feb 2025 and 9 Apr 2025. This takes the total cut in the repo rate to 100 bps over four months, which is significant. Along with these rate cuts, the RBI has also been bringing down the cash reserve ratio. It cut the CRR by 50 bps in two tranches of 25 bps each earlier – on 14 Dec 2024, and 28 Dec 2024. On 6 Jun 2025, it further cut the CRR by 100 bps in four phases of 25 bps each from September to November 2025. CRR is the percentage of a bank’s total deposits that must be kept with the RBI as liquid cash reserves. This cash kept with the RBI also does not earn any interest. Reducing the CRR has the effect of increasing the money multiplier because banks can lend more which, in turn, increases the creation of new deposits. A reduction in CRR from 4.5% to 3.0% has the effect of increasing the money multiplier from 22.2 to 33.3 which is significant. The RBI has also been doing open market operations (buying bonds and infusing cash) to increase liquidity in the system.

Two factors may have prompted the RBI to move so aggressively in recent months. The first is that inflation has turned quite benign in recent months. The second is that the dollar index has been extraordinarily weak over the last 6 months, down about 10% in this period. This has perhaps allayed any fears that RBI may have had about rupee instability in the face of aggressive rate cuts.

While the RBI has on 6 June, changed its monetary stance from accommodative to neutral, we believe that the moves over the last 5-6 months are significant in aiding liquidity in the system, bringing down the cost of borrowing and pushing the quantum of borrowing significantly. Towards the latter part of 2024 we saw some NPA related stress building up in the system, which is also expected to ease as lower interest rates improve a borrower’s ability to repay the loan. Moreover, lower interest rates also improve the economic viability of projects and should help push economic growth.

The above monetary policy moves have a significant impact on the banking sector. In the short term, the repo rate cut is expected to reduce net interest margins (NIMs) for banks because a large part of their advances (loans) is benchmarked to the repo rate. The interest rate on these advances which are benchmarked to the repo rate, will see an immediate cut while the reduced deposit rates will feed into the system as deposits roll over. The CRR cut, however, reduces the impact on NIMs. It also releases significant liquidity for the banks. Also, as we pointed out earlier, lower interest rates should boost demand for loans, thus pushing loan and deposit growth higher over the medium term.

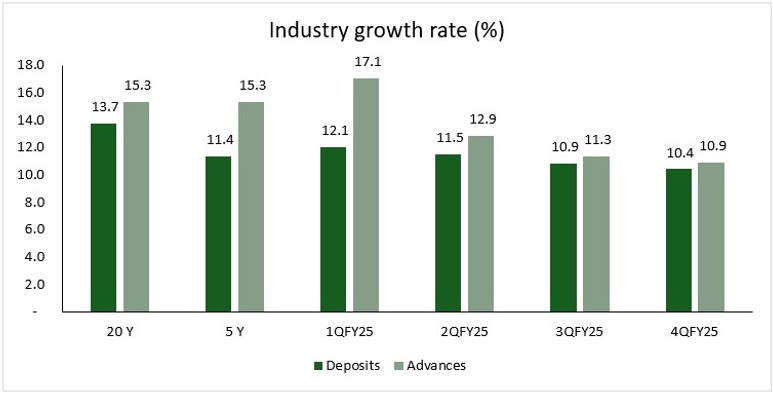

Another factor affecting the NIMs of the banks is that banks have been reducing the rate of interest they pay on savings bank accounts. In response to these repo rate cuts, most of the big banks (SBI, HDFC, ICICI) have cut the savings bank interest rate by 50 bps. Moreover, RBI’s earlier tightening of lending conditions through higher risk weights for certain categories of loans, has brought down loan growth, which was way ahead of deposit growth in Q1FY2025, more in sync with deposit growth in the fourth quarter of FY2025 (see chart below). This should further help NIMs as there is less of a scramble for deposits than before. All in all, though there is a short-term impact on NIMs, the monetary policy moves of the RBI are positive for the banking sector in the medium to long term.

On the fiscal side too, there is a major move by the government in the budget for FY2026, whereby income below Rs 12 lakhs is tax free in the hands of an individual. When you consider that India’s per capita income in FY2025 was Rs ~2.3 lakhs per year in nominal terms, tax exemption up to ~5 times income is indeed very generous. While this has implications for the long term in terms of narrowing the tax base, in the short term, it should put money in the hands of people to spend and invest.

We have been saying for a while that recent Indian corporate growth has been slower than it has been through history. The combined impact of these strong fiscal and monetary policy measures could potentially jumpstart the economy and push it to a higher growth path. While we remain somewhat cautious of the valuations prevailing in the broad market, we have managed to deploy a large chunk of our cash held in September 2024, over the last several months and cash levels now are on the lower side. We expect to continue to maintain our discipline of buying high quality stocks when they are available at reasonable prices.