November 2025: Corporate results improving a little but valuations remain elevated

In 2025

- December 2025: What we learnt from Warren Buffett and Charlie Munger

- November 2025: Corporate results improving a little but valuations remain elevated

- October 2025: General insurance – underwriting discipline is key

- September 2025: High indebtedness of the world poses risks for investors

- August 2025: Strong monetary and fiscal policy actions to aid growth

- July 2025: Indian market valuations, though lower than the peak, remain high

- June 2025: Strong monetary and fiscal measures likely to boost economic growth

- May 2025: A glimpse into FY2025 earnings

- April 2025: Tariffs – the sooner they are rolled back, the better

- March 2025: FY2025 – a tale of two halves

- February 2025: Indian equity market falls for 5 consecutive months

- January 2025: Returns in Indian equities compensate for rupee depreciation

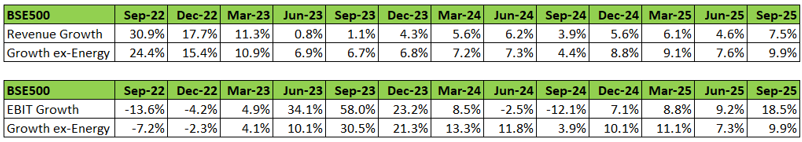

In this newsletter we discuss the results of the September 2025 quarter for the non-financials among the BSE500 constituents in terms of their revenue and EBIT growth. Below we present the results:

Revenue growth on 1Y basis is 7.5% and there is a strong growth in the EBIT for the September 2025 quarter though a large part of the growth is because of strong performance of the energy sector, where the oil PSUs reported very strong performance. If we exclude the volatile energy sector, revenue growth is 10% and EBIT growth is also 10%. For the June 2025 quarter, we reported ex-energy sector revenue growth of 7.6% and EBIT growth of 7.3%. To that extent, the September 2025 quarter is showing an improving trend. The EBIT growth for 3Y and 6Y basis (we have chosen 6Y instead of 5Y so as to eliminate the impact of covid on the numbers) is also reasonably strong at 14% each.

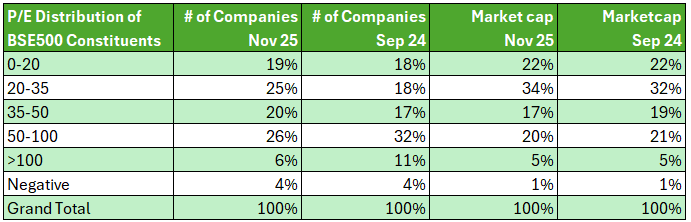

The Nifty scaled a new all time high in November 2025 on an intra-day basis. The last 12-14 months have been a period of consolidation for the Nifty. The median stock in the BSE500 is down 8.8% from its high on 27th September 2024. We now look at the distribution of Trailing Twelve Months (TTM) Price to Earnings Ratio (PE) among the BSE500 constituents and compare the same with September 2024 numbers.

In September 2024, 47% of the BSE500 constituents were trading at a PE higher than 50. In November 2025, that number has come down to 36% and in general it appears that the market is a little less expensive than the egregious levels it was trading at in Sep-24. The median PE of the BSE500 constituents has come down from 43.7 in Sep-24 to 35.9 in Nov-25. This is partly because of some earnings growth over the last year and partly because the median stock in the BSE500 is down 8.8%. Although the median TTM PE has come down from 43.7 to 35.9, the median market valuations at 35.9x earnings are still elevated.