October 2025: General insurance – underwriting discipline is key

In 2025

- December 2025: What we learnt from Warren Buffett and Charlie Munger

- November 2025: Corporate results improving a little but valuations remain elevated

- October 2025: General insurance – underwriting discipline is key

- September 2025: High indebtedness of the world poses risks for investors

- August 2025: Strong monetary and fiscal policy actions to aid growth

- July 2025: Indian market valuations, though lower than the peak, remain high

- June 2025: Strong monetary and fiscal measures likely to boost economic growth

- May 2025: A glimpse into FY2025 earnings

- April 2025: Tariffs – the sooner they are rolled back, the better

- March 2025: FY2025 – a tale of two halves

- February 2025: Indian equity market falls for 5 consecutive months

- January 2025: Returns in Indian equities compensate for rupee depreciation

In this newsletter we discuss the general insurance industry, which also finds a place in our portfolio currently. In general insurance, the service provider collects a premium from the customers to insure them for any financial liability that may occur in the future, due to an accident, hospitalization, fire, crop failure or any other such misfortune. It receives the premium up front and needs to pay out claims in the future depending on the tenure of the insurance policy. This creates a “float” for the insurance agency, and it can earn investment income on this float.

Of the Rs 100 that the insurance company receives as premium from its customers, a certain part, let’s say Rs 30 is spent on acquiring the business in terms of commission and other expenses. From the Rs. 70 that remains, the insurance company pays out claims over the lifetime of the policy. If the claims paid out are less than Rs 70, the insurance company makes an underwriting profit. At Rs 70 of claims paid out in the above example, the underwriting profit would be 0. Since the insurance premium is collected up front, and the claims are paid out over time, the insurance company can invest the resultant float and earn investment income. The higher your underwriting profit and the higher the investment income, the more profitable you will be as an insurance company.

As Warren Buffett has explained umpteen times in his letters to shareholders, with respect to Geico and their other general insurance businesses, the trick in this business is to underwrite policies when competitive intensity is less and to step away from underwriting business when competitive intensity is high. Most of the players in the industry try to gun for market share while the intelligent insurer underwrites in those segments, where competitive intensity is low and lets business go in those segments where competitive intensity is high. We believe that the two insurance companies, where we have direct exposure, ICICI Lombard and Go Digit, both are players who have historically shown discipline in underwriting, and this can really be the competitive advantage of a player in this business. This is akin to the credit discipline of a bank.

The other driver of profitability is the investment income which the insurance company can make on the float. Indian insurance companies have historically made 7-8% on their investment book as they are limited by regulation from placing more than 15% of their investment book in equities. Berkshire Hathaway, on the other hand, has historically placed a much larger part of its float into equities. Along with that, having Warren and Charlie as fund managers has allowed Berkshire to make extraordinary returns on their investments. Nevertheless the 7-8% return that a good insurance company in India makes, is sufficient to make good ROEs over the long term. What matters also is the duration of the float enjoyed by insurance companies. The Third-Party Automobile insurance in India, which has a longer time cycle of payment of premium to settlement of claim, allows the insurance company to have the float over a longer period and thus enhances profitability. However, the record is that only a handful of players in the insurance industry make good ROEs. We have of course tried to invest in those general insurance companies, which make good ROEs.

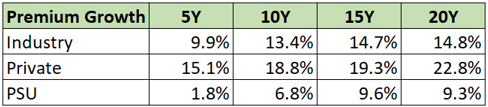

The general insurance industry has grown at a healthy pace over the long term (see table below). Within that, the private players have grown at a faster pace as they have taken market share from their PSU counterparts.

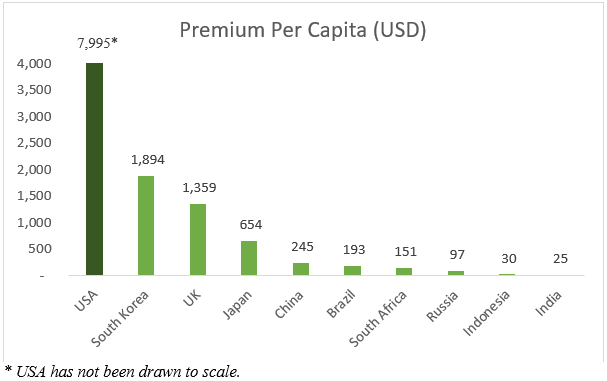

India remains an under-penetrated market for general insurance (See Chart below for a cross-country comparison). As such, we expect the industry to grow at or higher than nominal GDP growth over the long term. Within that, the private players may likely continue to gain some market share, though private players’ market share is now high at 69%.

Value of Insurance Premium per Capita:

As such this is a business with good long-term prospects of higher than nominal GDP growth. Success in this business depends on 1) Underwriting discipline 2) Scale in terms of distribution 3) Brand and 4) Investment Management capability for the float that the insurance company generates. Risk management, both in terms of underwriting as well as on the investment management side, plays an important role.

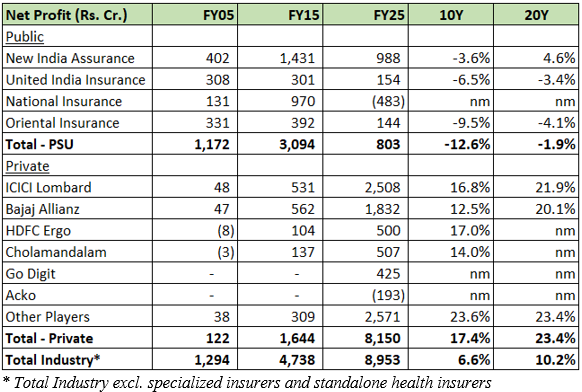

Below we present the net profit growth of different players in the industry over 10 and 20 years.

As we can see, only a few of the insurance companies have reported consistent growth in profits over the long term. We believe we have chosen the better players in the industry, who have exhibited good underwriting discipline, and have done a decent job on managing the investment book thus yielding reasonably good profitability. We expect them to continue on this path in the future. The stocks are also trading at reasonable valuations, making for a good investment case.