November 2021: Strong corporate results in Sep 21 quarter cause for optimism

In 2021

- December 2021: Why should one buy high quality companies

- November 2021: Strong corporate results in Sep 21 quarter cause for optimism

- October 2021: Cyclical upturn in the real estate sector?

- September 2021: Corporate tax growth implies strong corporate profit growth

- August 2021: Corporate results and tax revenues show encouraging trend

- July 2021: 17 year journey of Banyan Tree

- June 2021: ROE – the core engine of wealth creation

- May 2021: Nifty scales a new high

- April 2021: Why are markets not panicking in the second wave of covid in India?

- March 2021: Understanding the strength in the Indian equity market in the midst of covid

- February 2021: The role of interest rates in equity valuations

- January 2021: Economic recovery may be on its way

The Nifty was strong in the early part of November 2021, but just like October, it slid in the latter part of the month, to end the month down 3.9% over October 2021. The sharp fall towards the end of the month seemed to stem from fears of a highly mutated version of the SARS-Cov-2 virus, Omicron, which was detected in South Africa.

Most of the companies in our BSE-500 non-financials cohort have reported earnings for the quarter ended 30-Sep-21 and as promised last time, we would like to spend some time looking at these numbers.

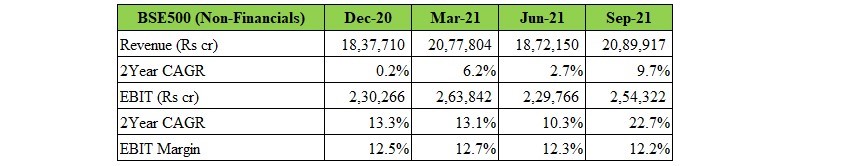

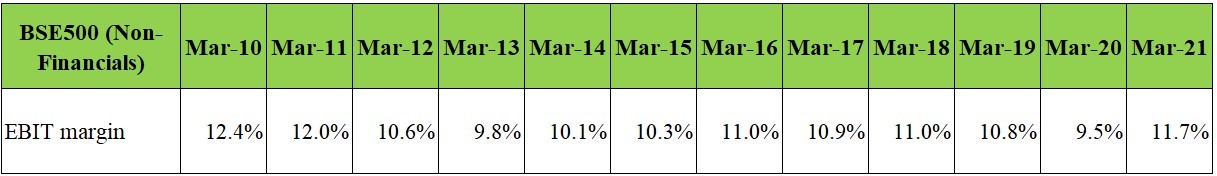

Total Revenues are up at a 9.7% 2-year CAGR and there has been a gradual improvement over the last 4 quarters. EBIT is up strongly at a 22.7% 2-year CAGR. EBIT margins are strong at 12.2%. A comparison with the historical EBIT margins is instructive – margins in Sep-21 are close to a 10-year high.

Revenue growth of 9.7% suggests that the corporate sector is reporting numbers which are as good as normal, and when you consider that in the context of the pandemic, it is quite surprising. A very significant contributor to the high EBIT growth in the Sep-21 quarter is the ‘Material’ sector which contains steel and non-ferrous metals as big contributors to the total. If we were to exclude the Material Sector, EBIT growth would drop to 12.5%, which though significantly lower, is still healthy. This throws up some interesting questions – is this pent-up demand? Or are we witnessing a turn in the economy which has been patchy for several years now? These questions will perhaps get fully answered only with the passage of time and when we have more data at our disposal.

Meanwhile stock markets all over the world were rocked by the discovery of a new highly mutated variant of the Sars-Cov-2 virus in South Africa, which has been detected in several countries around the globe in recent times. There are many conflicting opinions on the Omicron variant but this is still early days and the market has reacted to the uncertainty surrounding the new variant since the market always hates uncertainty. We will hopefully find out more about this new variant in the coming days. The Indian stock market has been in corrective mode for the last 6 weeks and this has increased the number of opportunities available to us among our universe of high-quality companies.