October 2021: Cyclical upturn in the real estate sector?

In 2021

- December 2021: Why should one buy high quality companies

- November 2021: Strong corporate results in Sep 21 quarter cause for optimism

- October 2021: Cyclical upturn in the real estate sector?

- September 2021: Corporate tax growth implies strong corporate profit growth

- August 2021: Corporate results and tax revenues show encouraging trend

- July 2021: 17 year journey of Banyan Tree

- June 2021: ROE – the core engine of wealth creation

- May 2021: Nifty scales a new high

- April 2021: Why are markets not panicking in the second wave of covid in India?

- March 2021: Understanding the strength in the Indian equity market in the midst of covid

- February 2021: The role of interest rates in equity valuations

- January 2021: Economic recovery may be on its way

The Nifty was strong for most of the month and at one point in the month was up 4.9% for the month. There was a subsequent sell off over the last 2 weeks – the Nifty gave up all its gains and was virtually flat (up 0.3%) for the month. Many of the high-flying stocks are down as much as 30% from their peaks and one senses a slight gloom in the air. It’s amazing how our brains are wired – we anchor to the highest price of a stock or index without realizing that the Nifty was actually flat for the month.

We wrote in our September newsletter about how the strong growth in corporate tax collections was suggesting that corporate profit growth has been quite strong and corporate profits have not only recovered from the shock of the pandemic but seem to be growing well and the early results bear out our theory – we will be able to comment better on aggregate corporate results next month. There are other indicators which are showing healthy signs. GST collections for the month of August, which are collected in September grew at a 2-year CAGR of 12.8% which is quite strong. Petrol consumed in September 2021 was 3.5% higher than the petrol consumed in February 2020 (pre-covid), suggesting increased mobility across the country. While fears of a third wave of covid have been around for quite some time, fingers crossed, it has not yet materialized and as a greater proportion of the population gets vaccinated, the likely human damage from a third wave may also be minimized.

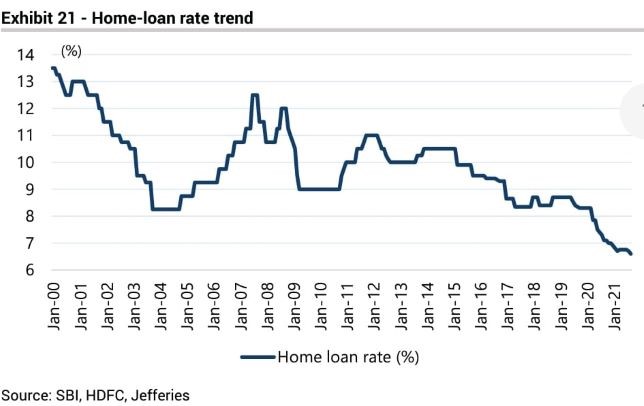

We now look at the property sector because it plays a pivotal role in the economy through its linkage with a large number of industries as also the employment it generates in the economy. The property sector has been in a funk for the last several years – the property cycle peaked in 2012 and although there has not been a major drop in prices – the passage of 9 years and a flat lining in prices have meant that affordability of homes is at a multi-year high. Interest rates on housing loans are at a two-decade low as one can see from the graph below:

Now we look at the housing unit sales for the quarter ended 30-Sep-21 for the top 8 cities in India (Please see graph above). Sales of housing units dropped dramatically in the first wave of covid, grew sharply in Q4FY2021 as the first wave receded and was also helped by the stamp duty waiver in a few states. In the September 2021 quarter, housing unit sales have grown at a 2-year CAGR of 5.1%. The increased momentum in hiring in the IT services sector is also expected to boost the real estate sector. With interest rates at multi decade lows and affordability quite good, we could well see a cyclical upturn in the property sector over the next few years, which could augur well for the economy as a whole.

Different pieces of the jig-saw puzzle like corporate tax collections, GST collections, historically low interest rates and the optimism about the real estate sector are coming together to suggest that the Indian economy which has had a prolonged cyclical downturn since 2012, could possibly be turning up cyclically. The total PE/VC investments into India in the first 9 months of CY2021 have reached $49 bn, up 52% yoy – this could further propel the Indian economy. The cyclical upturn in the Indian economy could also be the reason that the market has been much stronger than most expectations – markets tend to discount events into the future.

While the Nifty is flat for the month, the rough and tumble of moving stock prices has resulted in a few stocks in our investment universe coming close to the buy zone – if the trend of lower stock prices continues, we may see an expansion of the number of opportunities available to us to buy into. With the economy possibly ready for an upturn, we look forward to these opportunities and will continue to stay focused on the discipline of buying high quality companies at reasonable prices.