August 2023: A look at the June 2023 corporate results

In 2023

- December 2023: HDFC Bank- when elephants dance

- November 2023: Corporate growth over the medium and long term

- October 2023: Margin of Safety – central to investing

- September 2023: Mid-caps and small caps are quite the rage in Indian markets

- August 2023: A look at the June 2023 corporate results

- Will the US economy have a soft landing?

- Nifty at an All Time High

- Growth has slowed over the last 4 years

- Competitive edge is at the heart of company selection

- As banks fail around the world, Indian banks seem safe

- Poor corporate governance can invalidate an investment hypothesis

- January 2023: Momentum Investing vs Value Investing

After a strong showing, in the first 4 months of the financial year, the market consolidated in the month of August, and was down 2.5% for the month. Since most of the results for the June 2023 quarter are out, we thought we will review them to gauge corporate India’s progress.

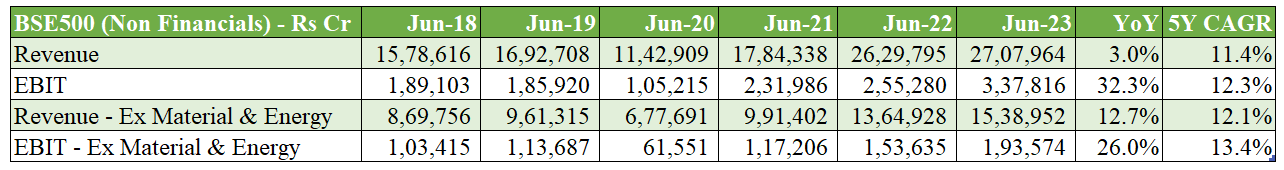

Corporate results for the June 2023 quarter are moderately good on the revenues front and quite strong on the operating profit (EBIT) front. We looked at the BSE500 ex-financials and found that while revenues were up 3.0% for Jun 2023, operating profits (EBIT) were up a strong 32.3%. However, two sectors, Material and Energy have some extra-ordinary factors which are driving the EBIT of the material sector down significantly year over year (yoy) while the oil PSUs have seen their profits grow significantly yoy because of government policy. If we exclude these 2 sectors from the calculations, revenues are up 12.7% and the EBIT is up a strong 26.0%. Two companies have had a very large delta in their profits for the yoy comparison – Tata Motors and Interglobe Aviation (Indigo Airlines). Even if we were to exclude these 2 companies, the EBIT growth is a very healthy 16.4%.

When we look at the 5 year growth picture for these companies, we find that total revenues are up 11.4% per annum while the EBIT is up 12.3%. This is in the same ball park as the long term corporate growth in India. It appears that we are limping back to normal, post-pandemic.

One problem confronting the global markets, particularly US and Europe, is the ratchet up in interest rates over the last 17 months. This poses a two-fold problem for markets. First, there is the drag of interest rates on demand for goods that are financed by borrowing such as housing, consumer durables, cars and credit card spending. The second, is the impact it has on valuations of stocks. We must remember that the intrinsic value of a stock is the sum total of all the free cash flows into eternity, discounted to today. When you discount future cash flows back to today, you need to use a discount rate, which is closely linked to the interest rates prevailing in the economy. As such, high interest rates should theoretically cause valuations to soften, particularly in comparison with a time when interest rates were close to zero or even negative.

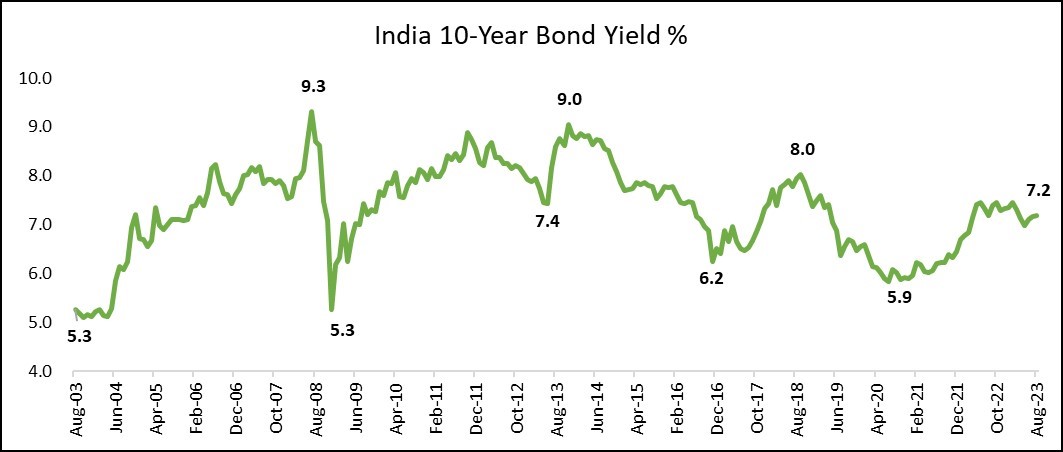

In India, however, despite some shocks, inflation has not been as out of whack from historical ranges as it has been in the West. As a result, the long-term bond yields in India are lower than medium term and long-term history.

The 10 year Indian government bond yield at 7.2% now, is lower than the rate pre-covid, and generally below peaks observed historically. This suggests that the inflation problem in India is not as acute as it is in the West and therefore the impact on bond prices is not as severe, as in the West where, for example, the US 10 year bond has lost 17.6% in value over the last 2 years.

However, the Indian market does trade at high valuations and the Nifty and the Sensex are trading at valuations which are close to the top end of the historical range. The corporate sector will need to continue to report high growth rates to justify these high valuations. We have been staying clear of the highly valued stocks in the market and have over time, reduced our weightage to expensive stocks in our portfolio. This is a continuous exercise for us – to sell expensive stocks in the portfolio and to redeploy in stocks that are trading at reasonable valuations and we intend to continue doing that in the future as well.