September 2024: Implications of Fed rate cut

In 2024

- December 2024: The primary market – the raison d’être of the secondary market

- November 2024: A glimpse into Sep-24 quarterly earnings

- October 2024: Weak Market Internals

- September 2024: Implications of Fed rate cut

- August 2024: BSE500 constituents trading at elevated valuations

- July 2024: Higher taxation to impact intrinsic value

- June 2024: Risks to the market and our process to handle them

- May 2024: Corporate Results Trends over the last 10 years

- April 2024: Our investment process explained through AMCs

- March 2024: Market cap to GDP – where is India in terms of valuation

- February 2024: Patience – a virtue in the investment journey

- January 2024: Party continues for mid caps, small caps and PSUs

The US Federal Reserve (Fed) cut the Fed funds rate by 50 basis points (bp) at its regular scheduled meeting on 18 September 2024. Back in 2020, to combat the economic impact of the pandemic, the Fed brought down interest rates to 0 and also did a lot of Quantitative Easing (QE – buying bonds from market participants to drive longer-term bond yields down and as a result, giving holders of those bonds, dollars). Due to the supply bottlenecks during the pandemic as well as the QE aka “money printing”, inflation spiked. At first, the Fed said that inflation was “transitory” but as inflation continued to climb, the Fed finally started a massive interest rate hike cycle which took the Fed Funds rate from 0-0.25% in Feb 2022 to a range of 5.25% to 5.50% in August 2023. Now, 13 months after its last increase, the Fed has decided to cut rates by 50 bps.

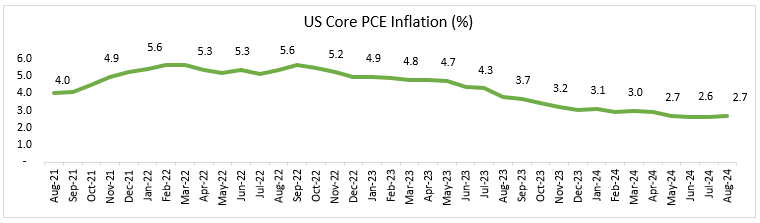

The Federal Reserve has a dual mandate – 1) Maximum Employment and 2) Price Stability. Let us see how both these factors have played out in recent times. If we look at the core PCE inflation (Personal Consumption Expenditures Index), considered the Fed’s preferred measure to gauge inflation, inflation has come down from 5.6% two years ago to 2.7% in August 2024. However, it is still a little above the Fed’s target of 2%.

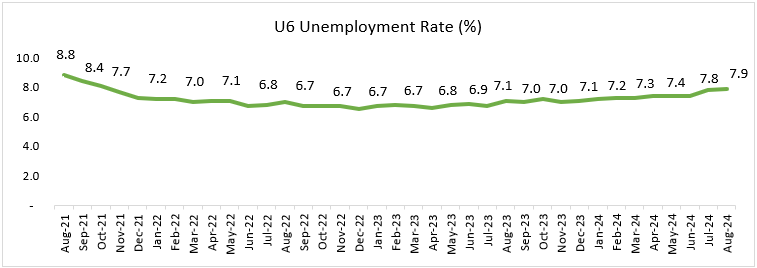

When we look at the unemployment rate, it has been edging up. Below we look at the U-6 Unemployment (percentage of the US workforce that is unemployed, plus those who are underemployed, marginally attached to the workforce, and have given up looking for work). The U6 is the most comprehensive measure of unemployment. As we can see, it has edged up in recent months from 7.1% in December 2023 to 7.9% in August 2024.

On the one hand, inflation has cooled from very high levels in September 2022 but still not down as much as the Fed would like, and on the other hand unemployment has inched up, which has made the job of the Fed difficult. The Fed had a choice of doing either a 25 bp cut in rates or a 50 bp or more. That it chose to do 50 bp is significant in our view, when we consider that at the previous meeting, they had decided not to cut rates. Also, the core PCE inflation has been stagnant for the last 3 months – so that doesn’t seem to be the new information driving the Fed decision of a 50 bp cut. One view of course is that the Fed simply does what the bond market is telling it to do. Bond yields have collapsed significantly over the last 3-4 months and that may have been the signal for the Fed to cut the Fed funds rate by 50 bp.

When we look back in history, we find that the Fed has started the rate-cutting cycle with a 50 bp or more cut on 3 occasions over the last 40 years – 1984, 2001, and 2007. In the 1980s US experienced very high inflation and the Fed had taken interest rates very high. In September 1984, the Fed funds rate was 11.75% and the Fed cut it by 175 bp to 10.0%. In January 2001 and September 2007, the 50 bp initial cut to begin the rate-cutting cycle was followed by several more cuts over the subsequent months and the US economy ended up in deep recession. This had implications for the stock market too which had a rough ride during this period.

While the jury is still out on whether we will have a soft landing for the US economy, or whether the landing will be hard, there are some red flags out there in the rising unemployment numbers, as also the falling ISM (Institute for Supply Management) data both for manufacturing and non-manufacturing indices. We shall continue to watch this space as the health of the US economy has a large bearing on the rest of the world.

Meanwhile, the 50 bp rate cut by the Fed should encourage other central bankers to cut interest rates too. The RBI governor could also follow suit and this could prop up interest rate-sensitive sectors in the Indian economy. As we have pointed out in earlier newsletters, the valuations of the broad market in India are high, and high growth would be required to fulfill the expectations that the market is pricing in. Any help from lower interest rates in this regard would be welcome.