May 2024: Corporate Results Trends over the last 10 years

In 2024

- December 2024: The primary market – the raison d’être of the secondary market

- November 2024: A glimpse into Sep-24 quarterly earnings

- October 2024: Weak Market Internals

- September 2024: Implications of Fed rate cut

- August 2024: BSE500 constituents trading at elevated valuations

- July 2024: Higher taxation to impact intrinsic value

- June 2024: Risks to the market and our process to handle them

- May 2024: Corporate Results Trends over the last 10 years

- April 2024: Our investment process explained through AMCs

- March 2024: Market cap to GDP – where is India in terms of valuation

- February 2024: Patience – a virtue in the investment journey

- January 2024: Party continues for mid caps, small caps and PSUs

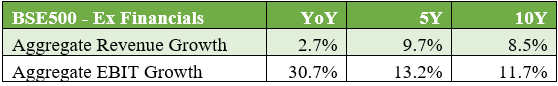

As most companies have now reported results for the financial year 2024, we thought we would look at, as usual, our BSE500 universe ex of the financials, to get a gauge of general corporate profitability and would also do a longer-term analysis of the same. Of the 432 ex-financials constituents of the BSE500, we have a 10-year available results history for 406 companies. These 406 constitute 97% of the total market capitalization of the BSE500 ex-financials and hence are quite representative of the whole.

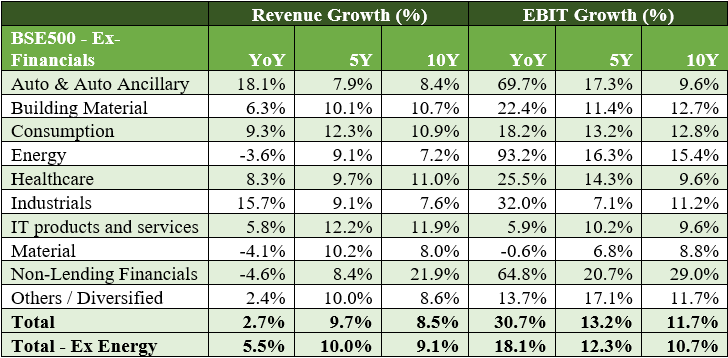

The current financial year has seen strong growth in profits though some part is attributable to the energy sector. The oil PSUs have reported strong profit growth in the current year. Ex of the energy sector, the operating profit (Earnings before Interest and Tax or EBIT) growth is 18.1%. On a 10-year basis, revenue growth appears to be on the lower side. The EBIT growth for the sample has outstripped revenue growth as margins have expanded from 9.3% in FY2014 to 12.4% in FY2024. The median margin over the last 10 years is 10.6% – so margins are currently at the higher end of the 10-year range. In our November 2023 newsletter, we reported that the 10-year growth in Sensex earnings had lagged the 20-year earnings growth. Part of the reason for this is that inflation has come down over the last 10 years. The above data seems to agree with the data we presented in our Nov-23 newsletter.

When we look at the results over the last 10 years, in terms of sectors, auto & auto ancillaries, healthcare, IT and material have trailed while non-lending financials is the stand-out outperformer, and the energy sector has done reasonably well.

Growth over the last 5 years has been better than over 10 years, helped by better operating margins. There may be limited scope for margins to expand further and future growth would likely need to come from robust revenue growth. One hopes that the many structural reforms like the GST, RERA, and IBC and the push on infrastructure will help boost growth into the future. For the market though, valuations of the broader market are on the expensive side and investors need to watch out for that.