HDFC Bank has been a large holding for us for a while and after the merger of HDFC Ltd with it, the position size has become even larger. Given its underperformance over the last 3 years, we felt that this is a good opportunity to discuss why we own HDFC Bank and why we have such a large weight in it. The weight that we would like to have in any stock in our portfolio depends on two factors – 1) How strong is the company’s competitive edge and the length of time that it can last and 2) How high is the sustainable growth rate of the company? HDFC Bank scores well on both parameters. The biggest source of competitive edge for HDFC Bank in a competitive banking industry is also two-fold: a) low cost of funds through current and savings bank account (CASA) deposits and b) Credit discipline.

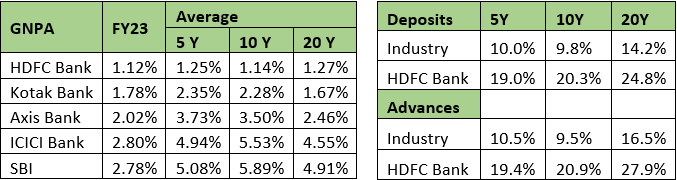

In an environment where the banking industry has grown its deposits at 9.8% pa over the last 10 years (using March 2023 numbers because it is pre-merger), HDFC Bank has grown its deposits at 20.3% per annum. CASA forms the bulk of the low-cost funds that a bank can access. HDFC Bank’s CASA deposits have grown at 19.5% for 10 years and 25.0% for 20 years, far outstripping the growth in deposits for the industry of 12.4% and 15.3% respectively. The liability franchise of HDFC Bank in the form of its extensive branch network is extremely important to its long-term competitive edge.

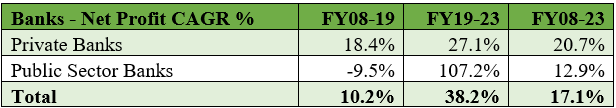

HDFC Bank is very well regarded for its credit discipline in the industry. It has the lowest Gross NPAs (nonperforming assets) in the industry over the last 20 years. From FY2016 to FY2018, the banking industry went through an upheaval as the RBI’s Asset Quality Review forced many banks to recognize their unrecognized NPAs and many of these went through the resolution process in NCLT courts under the Insolvency and Bankruptcy Code. It is interesting to note that HDFC Bank did not have even one large case in NCLT. This is testimony to its remarkable credit discipline which is embedded into the HDFC Bank culture.

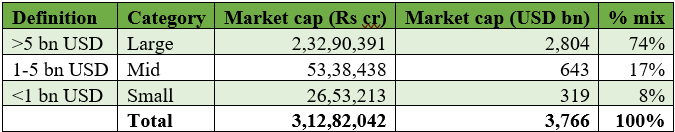

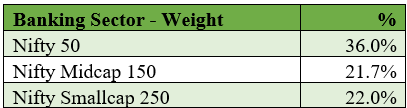

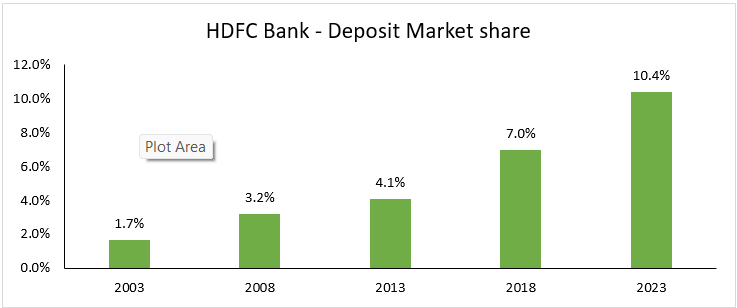

The second criterion for us to have a large weight in HDFC Bank is that it has a large runway of growth. Some people have questioned whether HDFC Bank can continue to grow at a fast pace after having achieved its large size. However, it is our assessment that with PSU banks still forming 66% of total deposits and 64% of CASA deposits, there is still room for private banks (including HDFC Bank) to increase their market share over time. HDFC Bank has relentlessly increased its market share over time and we expect the trend to continue. We prefer using market share of deposits, rather than of advances, because deposits drive loans in a bank on a sustainable basis.

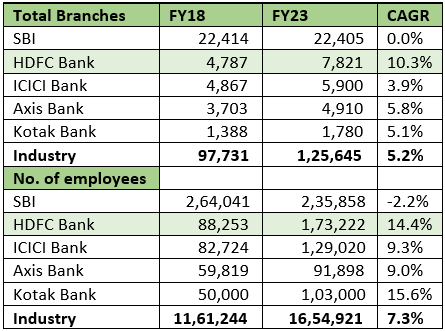

Further, HDFC Bank has been aggressively expanding its branches over the last 5 years to further strengthen its liability franchise. What this means, is that HDFC Bank has been upfronting investments in its business, in order to prepare for the next leg of growth. It is not too far-fetched to think that HDFC Bank can at some point, become as large as SBI, and it seems to be preparing for that with its branch expansion.

So, while the case for HDFC Bank is as strong as ever (HDFC Bank has seen stock price appreciation of 22.2% pa over the last 20 years and 18.6% pa for the last 10 years), there have been some apprehensions expressed by analysts. The first relates to the drag on its growth because of the merger. However, we believe, historically, HDFC Bank was at a disadvantage as it did not own a home loan customer compared to peer banks. One should note, home loan is a long duration product, and the lifetime value of a home loan customer is immense, and the bank has great cross-selling opportunities for both deposits and loans. With public sector banks still having 66% market share and HDFC Bank expanding it reach through branch expansion, it will continue to gain market share and grow at a faster rate compared to the industry. In addition, the banking sector itself is expected to grow at or above nominal GDP growth.

The second apprehension relates to inheritance of HDFC Limited’s NPAs in the wholesale book which came in as a bit of a surprise. However, when we look at the overall NPAs for the combined entity they continue to be reasonably low, and hence in the overall scheme of things both credit quality and profitability continue to be strong and best in class.

With the merger, HDFC Bank also becomes the ultimate parent to all the subsidiaries of HDFC Limited i.e. life insurance, general insurance, and asset management etc. From being a group company to ultimate parent, the relationship with them will improve with better focus and engagement. Perhaps this will result in higher growth and profitability in the subsidiaries and lead to better value for HDFC Bank as well.

The third apprehension was related to a technical factor i.e. the uncertainty about the weight of the combined entity in the global indices. HDFC Bank has historically had a large proportion of its shareholding held by FPIs (Foreign Portfolio Investors). Since there is a restriction on FPIs to own only 74% in an Indian bank, the large FPI holding in HDFC Bank reduces the headroom for an FPI to own HDFC Bank and that reduces the weight indices providers like MSCI would give to HDFC Bank. While this technical problem has been there with HDFC Bank for several years, the merger further brought this into focus and MSCI has currently allocated only half the weight to HDFC Bank as it would normally deserve, based on its free float market capitalization. Further, mutual funds in India are only permitted to buy a maximum of 10% in a particular stock. Since HDFC Bank now has a 13.5% weight in the Nifty50 and an 8.4% weight in the Nifty500, many mutual funds have been forced to reduce their weight in HDFC Bank. At the minimum, this does not allow them to own HDFC Bank, in line with its representation in the indices.

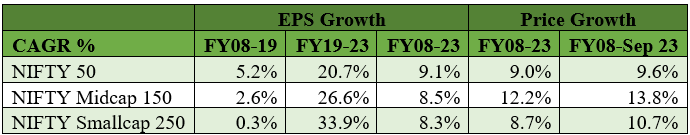

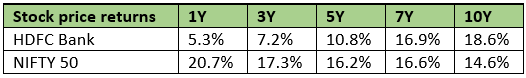

For us, as long-term investors, these technical factors, though a good explainer of short-term market returns, are not a consideration from the long-term point of view. We believe that eventually stocks are slaves of earnings and it is hard to ignore a business, growing at a strong 18-20% pa, despite whatever technical factors may be impeding it. The table below shows the performance of HDFC Bank against the Nifty over the years. One of the reasons for poor 3 and 5-year performance is that valuations 3 and 5 years ago were on the higher side, but valuations are lower now. Please note that despite recent underperformance, over a 10-year basis, HDFC Bank continues to outperform the Nifty because of its superior earnings growth.

Due to its underperformance over the last several years, HDFC Bank now trades at the bottom end of our valuation band. This is particularly so, as we are at the end of December and now rolling over our valuation bands to the next year. As per consensus analyst estimates, HDFC Bank is expected to report 18-20% over the next 2-3 years, in line with its 10-year history. In a market where it is very hard to find an attractive business trading at a reasonable price, HDFC Bank looks like a mouth- watering opportunity to us. We use such words sparingly (have used it only once before in our newsletters over the last 18 odd years) and we remain confident that HDFC Bank will deliver good returns to shareholders over the foreseeable future.