Central to our investment process is the idea of investing in ‘high quality’ companies for the long term and to buy them at prices which are at a discount to their intrinsic value. Our experience over the last several years confirms our belief that if one sticks to this process in a disciplined manner, it not only leads to superior returns over the long term, it also reduces the overall risk to the portfolio. In this note, we would like to present data to support this thesis.

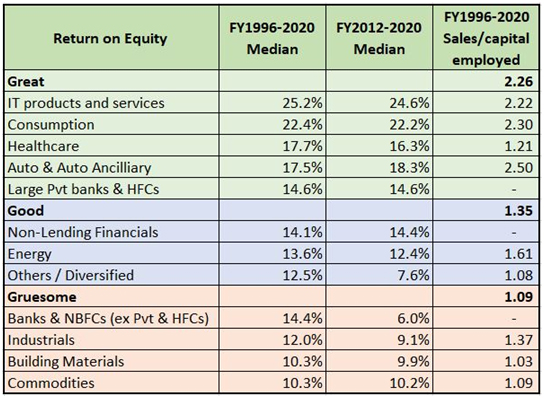

A high-quality company is one that is highly profitable and is able to grow consistently, at close to, or higher than nominal GDP growth rates. We have found that some sectors are naturally more profitable, as measured by their return on equity (RoE) than others because they are less capital intensive, both in terms of fixed assets and working capital. The following table presents the price performance of various Nifty sectoral indices over the last decade and the annual Earnings per Share (EPS) growth and the RoEs for different sectors.

| Index | 10Y Index Return | 10Y EPS CAGR | 10Y Median RoE |

|---|---|---|---|

| Nifty IT | 20.2% | 13.7% | 26.6% |

| Nifty Private Bank | 17.6% | 13.5% | 13.3% |

| Nifty FMCG | 13.9% | 11.1% | 41.2% |

| Nifty Healthcare | 13.7% | 8.5% | 17.5% |

| Nifty Oil & Gas | 12.9% | 9.2% | 13.2% |

| Nifty Auto | 12.4% | 4.1% | 17.9% |

| Nifty Realty | 10.1% | -2.4% | 7.9% |

| Nifty Metal | 8.4% | 1.4% | 11.7% |

| Nifty PSU Bank | -0.3% | -11.4% | 5.7% |

The correlation between Index performance and EPS growth is 95% and correlation with RoE is 54% (80% if FMCG is excluded from the calculation). Essentially historic data suggests that an investor can make superior returns with businesses that have high levels of profitability, and high rates of growth. One also observes that the sectors in the bottom half of above table are far more capital intensive than those in the top half. The top half of the table has superior price performance as well as better profitability and growth. The sectors that are capital intensive also tend to raise more capital from investors, thus diluting their earnings growth. You will notice that most of the stocks in our portfolio are low in capital intensity and are typically from sectors in the top half of this table.

Over the past 12 months the best performing sectors have been Metals, IT, Realty and PSU Banks. IT has been witnessing a structural tailwind, whereas the other strong performers for the year are coming off some serious pain over the last several years. Metals have benefited from strong commodity prices and in real estate there is some optimism of a turnaround after several years of a slowdown. PSU banks which have been flat in terms of price performance over the last decade, are coming off very depressed levels. The weakest performing sectors over the past 12 months include private sector banks and FMCG, which have a long-term track record of fairly good price performance. We are not too concerned about short term performance of companies and intend to remain focused on our universe of high- quality companies that have performed well over long periods of time.